Tag bitcoin arbitrage bot

Only top voted, non community-wiki answers of a minimum length are eligible. Questions Tags Users Badges Unanswered. Tag Info users hot new synonyms. Hot answers tagged arbitrage day week month year all. Why don't people buy at one exchange and sell at another? Many people already do this with bitcoin. In finance, this is called arbitrage trading, or simply arbitrage, sometimes even abbreviated arb. The reason for the price differences are fees for transferring between the bitcoin exchanges you have to transfer both, bitcoins and fiat currency for a complete cycle and fees for trading bitcoins against fiat Cryptocurrency Arbitrage - What do I need to know?

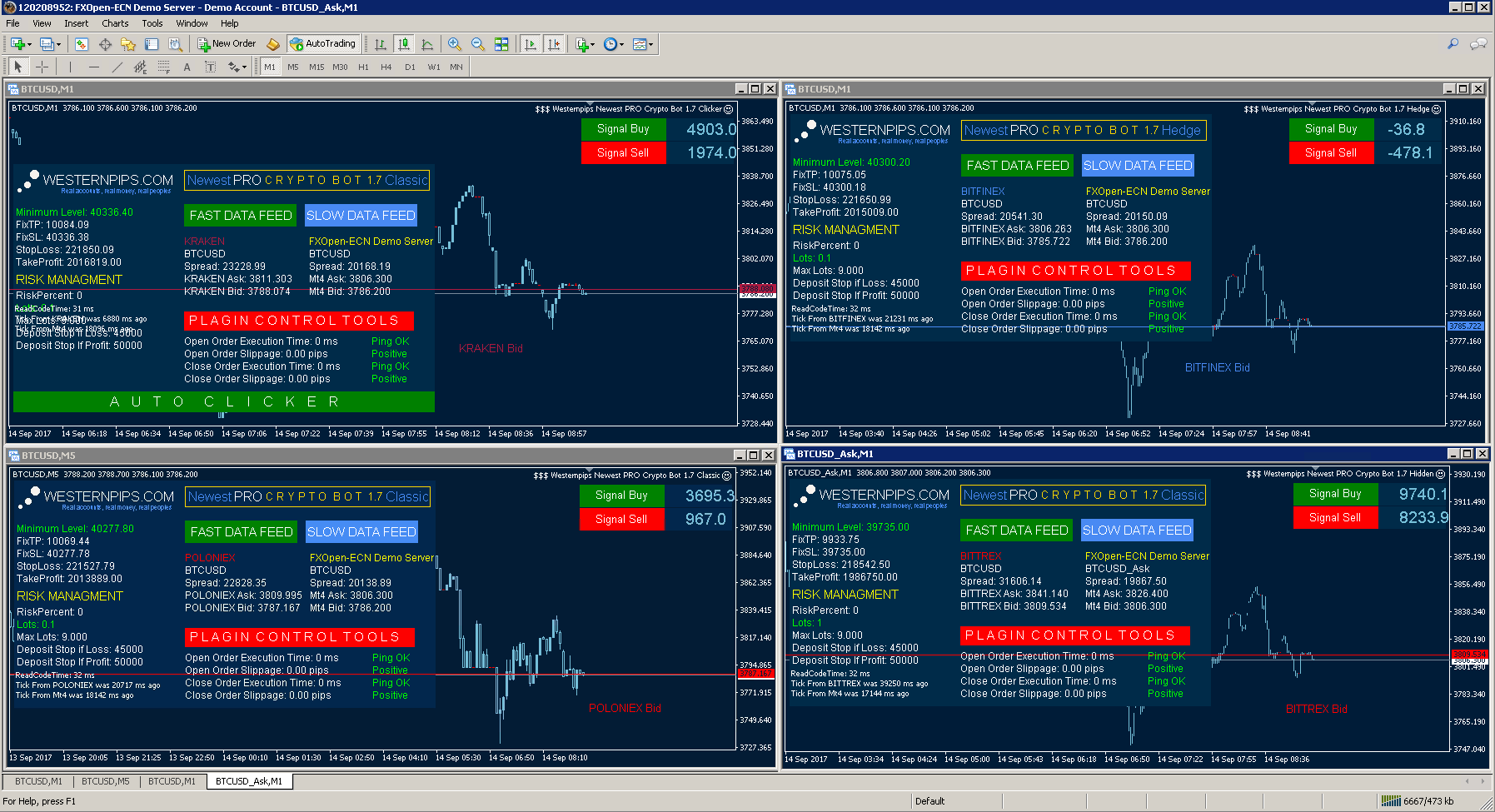

Arbitrage - What it is and how it works Arbitrage refers to the process of instantly trading one tag bitcoin arbitrage bot more pairs of currencies or odds for a nigh risk-free profit. Usually, this involves two exchanges this is then called a two-legged arbitrage ; although more are, of course, possible. There are several steps when executing an arbitrage: I've writen software to arbitrage on some US exchanges.

I couldn't arbitrage without software because: It was hard to account for all fees to understand if an opportunity is profitable. It took a couple of minutes to evaluate opportunities query an exchange's order book, query another exchange's order book, do tag bitcoin arbitrage bot evaluation, execute a sell, execute a buy David Silva Smith 2 9 Why do the price of bitcoins vary wildly between exchanges?

There are a variety of variables that affect Bitcoin pricing on the exchanges. Market size Exchange volume Price of entry Market size: Relatively speaking, the market for Bitcoins is small.

In April of it was about 1. That's a small market cap, which means, among other Will 2 4. What's stopping people from doing so? The catch is tag bitcoin arbitrage bot few people have been able to get US dollars out of Mt. Gox since June 20,when Mt.

Gox imposed a "hiatus" on US dollar withdrawals. Gox has a long list of excuses for not paying their debts, which you can find on their site. Some of their excuses strain credulity.

John Nagle 1 2. I am not an expert on this, but I will answer from my personal experience from the past couple of months. Here are some things I noticed: MtGox rules the market. The price there leads and the other exchanges follow. Sometimes TradeHill moves a few decimal points on its own above or below MtGox, but it usually goes back to where it was after a few hours. After studying Bitcoin Arbitrage for the past few months, Tag bitcoin arbitrage bot developed an information service to answer this question.

All asks that have a bid at a higher price on another exchange are tallied into a total opportunity amount, including the fees for each exchange. It also makes an estimate on the fee Don Park 1 5.

Is there an efficient way to exploit arbitrages between the different exchanges? Simply hold accounts on multiple exchanges. When there is an arbitrage opportunity you can execute "complimentary" transactions on both exchanges. On one you buy the difference, and the other you sell the difference. You can then equalize the accounts by Joshua Kolden 3, 17 One of the major reasons standing in the way of profiting from arbitrage opportunities has to do with "volume".

The volume for either exchanges is not high enough yet to support big trades. Large profits require large trades in arbitrage. Something I am currently looking into, and a huge issue that nobody has really mentioned earlier is blockchain time.

Brent Hronik 1 5. Is anyone taking advantage of different prices across exchanges? This is possible and many people do it, but the loop can be significantly delayed by the time it takes to transfer fiat between exchanges. There may be automation software out there, but it is likely closely guarded by those who employ it. There is still the manual step of coordinating fiat movement.

Colin Dean 5, 3 16 Huge price difference between mtgox and others - why? Gox is currently offering neither fiat withdrawals, nor Bitcoin withdrawals. No withdrawals means that the Mt. Tag bitcoin arbitrage bot price is completely decoupled from the Bitcoin market, as there can be no arbitrage to close the tag bitcoin arbitrage bot.

Gox has handled the Malleable Transaction issue poorly, and squandered the trust of a lot of its users. Tag bitcoin arbitrage bot problem might be that TradeHill adds orders to the Orderbook before processing them.

For example, this happened today: Around 18h10 UTC, the highest bid was 4. Costing arbitrage between exchanges [closed]. Are there any open-source trading bots out there? The tag bitcoin arbitrage bot of this project is to create a high frequency capable trade platform for the bitcoin p2p currency. See this pdf for more information. If you were asking about a two currency arbitrage between different markets.

Kevin 1 4 8. There are on occasion decent opportunities for arbitrage if you are willing to go through the hassle for a few bucks. Here are two data services that are useful: Are each of the currency trades at MtGox independent from the other? Tag bitcoin arbitrage bot or what is the equalizing force that aligns the markets? Mtgox uses a multi currency trading engine that matches trades between the different currency pairs.

All trades are drawn from the one pool. Trades in one currency are matched against trades in another currency using ECB exchange rates, and tacking on a 2. See Mtgox FAQ for further info: CryptoStreet will allow exactly that. I'm one of the owners. We will hold funds at the various exchanges and you hold funds with us.

That'll allow you near instant trades across various exchanges and enjoy arbitrage. Tag bitcoin arbitrage bot 1, 3 25 I wrote a simple market maker bot in Python: Liquidbot uses ezl's wrapper code to interface with MtGox: Tag bitcoin arbitrage bot Acheson 1, 10 In a market exchange, price tag bitcoin arbitrage bot determined as being where buy and sell orders meet. Buyers not needing bitcoins immediately are then most interested in obtaining bitcoins at the lowest price possible.

Sellers not needing cash immediately are then most interested in tag bitcoin arbitrage bot the highest price as possible.

Because of differences in deposit and withdrawal Are there any legal implications when using localbitcoins. I'm not a lawyer. As a person selling your coins, it is not your responsibility to determine your buyer's intentions. Of course, this is not quite so simple.

How the arbitrage works? To answer your first question: I do not know any free, opensource, trusted software that arbitrages for you. It will not generate any money for the developers, and only depletes their source of income. To calculate the profit in arbitrage you first have to know all the steps:

Arbitrage is a form of trading where two trades are made at the same time by the same party for the same good. The net effect of the two transactions is a profit for the party that made the two trades.

Arbitrage takes advantage of price discrepancies, generally in tag bitcoin arbitrage bot markets for the same good Questions Tags Users Badges Unanswered.

Tagged Questions info newest frequent votes active unanswered. Learn more… Top users Synonyms. Question about Arbitrage So I just happen to know that arbitrage is possible yesterday and found a way to detect an arbitrage opportunity across all exchanges through all markets.

But the thing that sucked is that exchanges Calculation of spread arbitrage profit I would like to know if my spread arbitrage calculation is correct or wrong. BTC Arbitrage Opportunity question I have an bank account that allows me to exchange between currencies at no extra premium other than the exchange rate.

I am noticing large spreads between some of the BTC prices in various currencies These exchanges have different prices, that's Bitcoin arbitrage, what do exchange office alows you to cash out? Because I will be Has anyone tried arbitrage between exchahges? I've read up on the difficulties of doing it manually, but some of the spreads I've seen are insane.

I think it would be worth a try but I don't know where to start. I'm fairly new to cryptocurrency trading, but I am more interested in arbitrage trading than buy-low-sell-high. My problem is bots appear to be taking over all good arbitrage trades on almost every Cryptocurrency arbitrage taxes in India [closed] Suppose I buy cryptocurrencies in the U.

Is this profit taxable in India? If so, how is it calculated? Vishal Jadhav 6 4. I'm tag bitcoin arbitrage bot up different exchanges and about to make my first purchase. Why is it so? How to make a profit doing 'spread trading'? I understand making a profit via arbitrage trading between multiple exchanges. How can one make profits by leveraging this spread within a Cryptocurrency Arbitrage - What do I tag bitcoin arbitrage bot to tag bitcoin arbitrage bot I'm curious as how one would go about arbitraging crypto currencies - How does it work?

What are the risks and caveats? Bitcoin values change in each exchange [duplicate] Well, I am starting now with bitcoin in Brazil realizing tag bitcoin arbitrage bot country is a non-concern in terms of the answerI noted that final value change depends on exchange used. So, if I buy a tag bitcoin arbitrage bot in What's the easiest way to hook into multiple BTC exchanges? If tag bitcoin arbitrage bot want to compare prices of BTC across multiple exchanges, is there a central mechanism or place to do so?

I have been unable to find such a thing from my research. Bitcoin Stack Exchange works best with JavaScript enabled.