Ripple trade bot account

Of course this depends on the liquidity of the path and the available funds of each arbitrageur. The answer is yes:. Following is an example ledger ripple trade bot account many arbitrage bots are fighting to exploit the same opportunity.

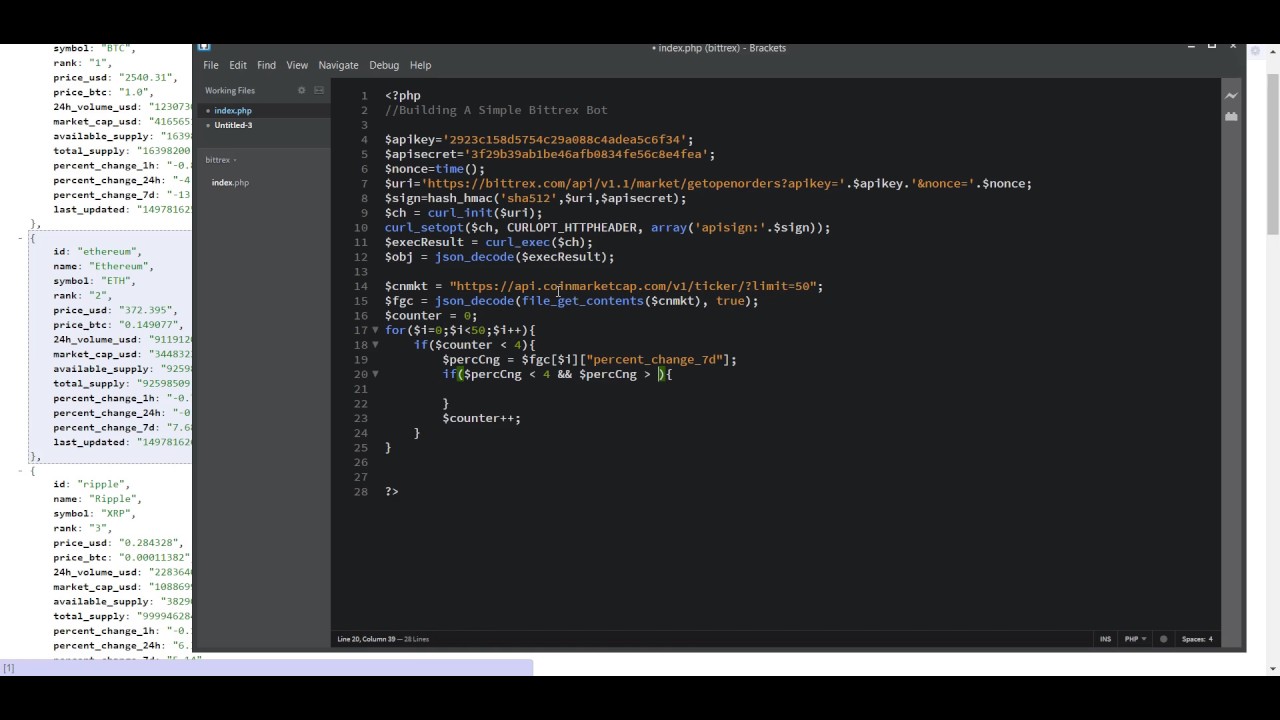

Ripple trade bot account that, or Payments are modified to support circular paths along up to say 16 order books without the need for rippling enabled intermediaries. Payments, on paper, are meant to offer this. The author has demonstrated that the transaction ordering can be fixed with two accounts. Unfortunately JIRA links are now broken due to the bug tracker being made private. There is ripple trade bot account confusion amongst the community and no conclusive documentation on this ordering.

Iterates set in transaction id order, putting any failures of the transaction engine into retriableTransactions which is seeded by the root hash of the transaction ShaMap:. Ripple is hardly suitable for HFT, but it does share one thing in common with HFT markets, and that is that there is latency between a trade being known to the network and it being executed and applied to a closed ledger. Well, strictly ripple trade bot account by Account and then Sequence with the Account order seeded by a root hash of all other transactions to be considered makes a lot of sense, as any new transactions changes the order for all other transactions and is very hard to know for certain unless your transaction is the last one to be submitted to the network in ripple trade bot account for that particular ledger. This is a controversial topic that ripple trade bot account created much anger directed towards High Frequency Trading.

The Ripple network is ripe for arbitrage given the abundance of currencies and multiple markets for each of those currencies. This exploit is unexploited by ripple trade bot account author. Iterates set in transaction id order, putting any failures of the transaction engine into retriableTransactions which is seeded by the root hash of the transaction ShaMap:.

This signature is then inserted back into the binary serialized form which is hashed again to produce a transaction id through which it can be uniquely identified. The wider the gap between the funded tip of an order book and the next funded offer, the greater the profit. But as far as I can tell it is only the application on line that actually matters for the transaction ordering of a closed and final ledger. An extra benefit of this would be much reduced transaction size, many OfferCreates reduced to a single Payment.

Obviously there are tight time constraints to find opportunities in a ledger, sign number of trades x n and make sure all the transactions reach the validators before the next ledger closes. The author is certain that this benchmark could be ripple trade bot account. Accounts with small transaction counts would be expected to turn up in a normal distribution of the transaction id front nibble, the expected median percentage being 6.

The wider the gap between the funded tip of an order book and the next funded offer, the greater the profit. As discussed at length in the book Flash Boys, given enough relative time advantage, it is possible for one actor to discover a large trade and execute other trades in advance to take advantage of that initial trade executing, often to the disadvantage of the original trader. All non-validating nodes do actually process the transactions, but only the agreed ledger ripple trade bot account the trusted validators counts for all intents and purposes. Payments are better in the sense that they have support ripple trade bot account the flag combination tfLimitQuality tfPartialPayment tfNoDirectRipplewhich is exactly what an arbitrageur would want if it actually worked for a circular path! This signature is then inserted back into the binary serialized form which is hashed again to produce a transaction id through which it can be uniquely identified.