Orderbook bitcoin futures

They are created when new limit orders in the order book are filled. As reported recently, many institutions and banks are increasingly interested in cryptocurrencies futures contracts as the Bitcoin prices sore. Each side Long and Short places some portion of the contract value in margin. Cboe Global Markets is also planning to launch the Orderbook bitcoin futures futures orderbook bitcoin futures the first Bitcoin-related financial product on a traditional, regulated exchange.

Cryptocurrencies futures contracts might help spread the word about cryptocurrencies to more people in the banking world and increase usage of cryptocurrencies from a positive perspective. There are two types of Bitcoin futures contracts, namely Quanto and Inverse. The company is still working with regulator -- which is U. Each side Long and Short places some portion of the contract value in margin. A futures contract is a contract that comes into existence when two people agree to enter into it.

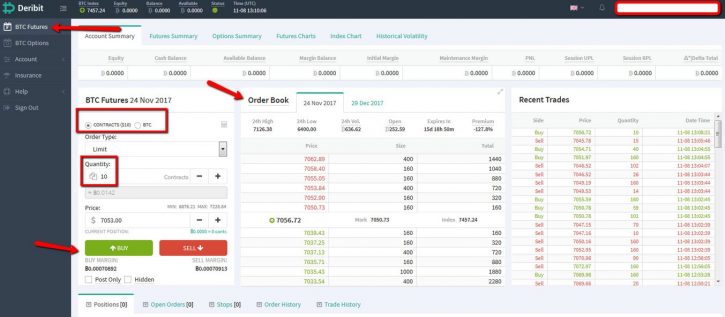

Bitcoin futures contracts derive their value from Bitcoin and settle at price of the commodity in the future on a particular exchange or an index representing a basket of prices at different orderbook bitcoin futures. Futures contracts have a specific expiration date when they expire and one must re-open on the new contract period to orderbook bitcoin futures their position or to render the contract valuable for may be another week. Currently, JPMorgan allows clients some access to bitcoin through an exchange-traded note, namely routing their orders to exchanges. Inverse helps maintain the contract value through price fluctuations and is therefore ideal for speculators and hedgers.

November 22, November 22, David Kariuki. The company is still working with regulator -- which is U. CME Group Incorderbook bitcoin futures biggest futures exchange, has said orderbook bitcoin futures it hopes to launch a Bitcoin futures contract this year. Different exchanges have different periodic dates daily or weekly when the contract period's profits are settled even if the contract has not expired. Cryptocurrencies futures contracts might help spread the word about cryptocurrencies to more people in the banking world and increase usage of cryptocurrencies from a positive perspective.

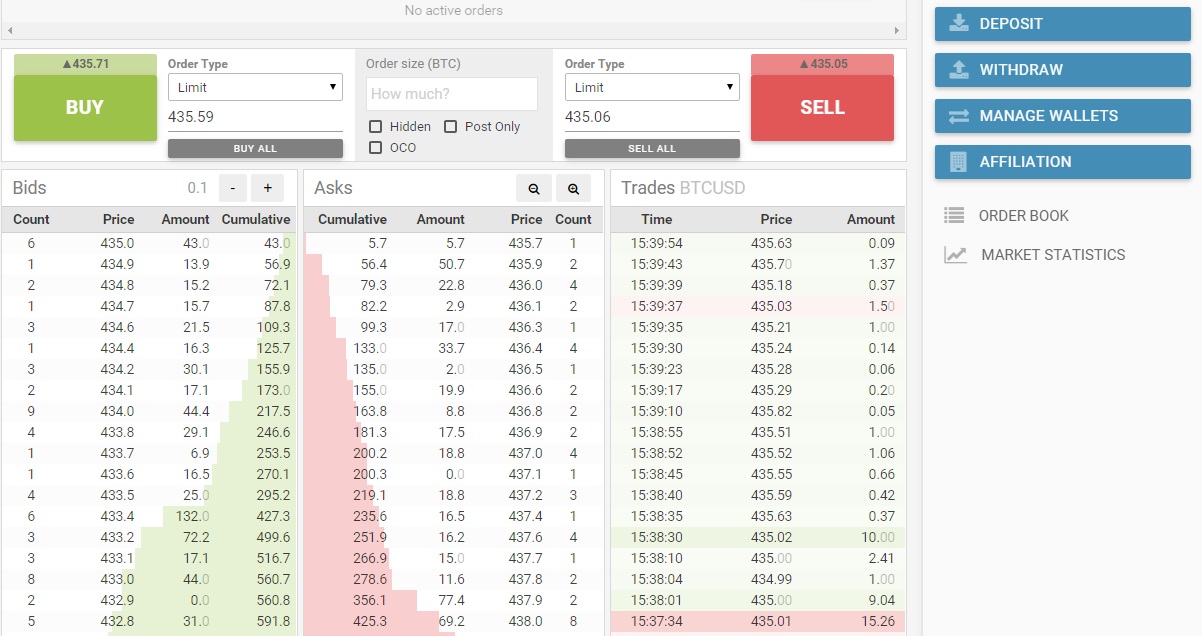

November 22, November 22, David Kariuki. There are two types of Bitcoin futures contracts, namely Quanto and Inverse. Anyone is also allowed to realize the profit or loss before expiration of the contract by fulfilling the buy and sell orders on the live order book, so no one is not forced to hold it to expiration. CME orderbook bitcoin futures not allow the futures to trade at prices 20 orderbook bitcoin futures above or below the settlement price from the previous day according to their website. A futures contract is a contract that comes into existence when two people agree to enter into it.

Read more about Bitcoin futures contracts here. November 22, November 22, David Kariuki. Futures contracts have a specific expiration date when they expire and one must re-open orderbook bitcoin futures the new contract period to maintain their position or orderbook bitcoin futures render the contract valuable for may be another week. A futures contract is a contract that comes into existence when two people agree to enter into it.

Majority are Inverse and are denominated in USD terms. As reported recently, orderbook bitcoin futures institutions and banks are increasingly interested in cryptocurrencies futures contracts as the Bitcoin prices sore. November 22, November 22, David Kariuki.