Live brownbagbuilding a bitcoin arbitrage bot with tyler coyner

Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto [11] and released as open-source software in Bitcoins are ar 15 bitcoin stock price as a reward for a process known as mining.

They can be exchanged for other currencies, [13] products, and services. As of Februaryovermerchants and vendors accepted bitcoin as payment. The word bitcoin first occurred and was defined in the white paper [5] that was published on 31 October There is no uniform convention for bitcoin capitalization. Some sources use Ar 15 bitcoin stock price capitalized, to refer to the technology and network and bitcoinlowercase, to refer to the unit of account.

The unit of account of the bitcoin system is a bitcoin. Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 0. As with most new symbols, font support is very limited. Typefaces supporting it include Horta. On 18 Augustthe domain name "bitcoin. In Januarythe bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block.

This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking. The receiver of the first bitcoin transaction was cypherpunk Hal Finneywho created the first reusable proof-of-work system RPOW in In the early days, Nakamoto is estimated to have mined 1 million bitcoins. So, if I get hit by a bus, it would be clear that the project would go on. Over the history of Bitcoin there have been several spins offs and deliberate hard forks that have lived on as separate blockchains.

These have come to be known as "altcoins", short for alternative coins, since Bitcoin was the first blockchain and these are derivative of it. These spin offs occur so that new ideas can be tested, when the scope of that idea is outside that of Bitcoin, or when the community is split about merging such changes.

Since then there have been numerous forks of Bitcoin. See list of bitcoin forks. The blockchain is a public ledger that records bitcoin transactions.

A novel solution accomplishes this without any trusted central authority: The blockchain is a distributed database — to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight.

Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions. Transactions are defined using a Forth -like scripting language. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output.

To prevent double spending, each input must refer to a previous unspent output in the blockchain. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs coins used to pay can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer. Paying a transaction fee is optional. Because the size of mined blocks is capped by the network, miners choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee.

The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs. In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address.

This computation can be done in a split second. But the reverse computing the private key of a given bitcoin address is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair ar 15 bitcoin stock price is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used for that.

To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key. If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; [9] the coins are then unusable, and effectively lost. Mining is a record-keeping service done through the use ar 15 bitcoin stock price computer processing power.

To be accepted by the rest of the network, a new block must contain a so-called proof-of-work PoW. Every 2, blocks approximately 14 days at roughly 10 min per blockthe difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten ar 15 bitcoin stock price. In this way the system automatically adapts to the total amount of mining power on the network. The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.

Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment.

In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.

The successful miner finding the new block is rewarded with newly created bitcoins and transaction ar 15 bitcoin stock price. To claim the reward, a special transaction called a coinbase is included with the processed payments. The bitcoin protocol specifies that the reward for adding a block will be halved everyblocks approximately every four years.

Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins [f] will be reached c. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation. A wallet stores the information necessary to transact bitcoins.

While wallets are often described as a place to hold [60] or store bitcoins, [61] due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings" [61] and allows one to access and spend them. Bitcoin uses public-key cryptographyin which two cryptographic keys, one public and one private, ar 15 bitcoin stock price generated.

There are three modes which wallets can operate in. They have an inverse relationship with regards to trustlessness and computational requirements. Third-party internet services called online wallets offer similar functionality but may be ar 15 bitcoin stock price to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware.

A malicious provider or a breach in server security may cause entrusted bitcoins to be ar 15 bitcoin stock price. An example of such ar 15 bitcoin stock price security breach occurred with Mt. Physical wallets store offline the credentials necessary to spend bitcoins.

Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions. The first wallet program — simply named "Bitcoin" — was released in by Satoshi Nakamoto as open-source code. While a decentralized system cannot have an "official" implementation, Bitcoin Core is considered by some to be bitcoin's preferred implementation.

Bitcoin was designed not to need a central authority [5] and the bitcoin network is considered to be decentralized. In mining pool Ghash. The pool has voluntarily capped their hashing power at Bitcoin is pseudonymousmeaning that funds are not tied to real-world entities but rather bitcoin addresses.

Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" e.

To heighten financial privacy, a new bitcoin address can be generated for each transaction. Wallets and ar 15 bitcoin stock price software technically handle all bitcoins as equivalent, establishing the basic level of fungibility.

Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, ar 15 bitcoin stock price that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility.

The blocks in the blockchain were originally limited to 32 megabyte in size. The block size limit of one megabyte was introduced by Satoshi Nakamoto inas an anti-spam measure. On 24 August at ar 15 bitcoin stock price, Segregated Witness SegWit went live, introducing a new transaction format where signature data is separated and known as the witness. The upgrade replaced the block size limit with a limit on a new measure called block weightwhich counts non-witness data four times as much as witness data, and allows a maximum weight of 4 million.

Bitcoin is a digital asset designed by its inventor, Satoshi Nakamoto, to work ar 15 bitcoin stock price a currency. The question whether bitcoin is a currency or not is still disputed. According to research produced by Cambridge Universitythere were between 2. The number of users has grown significantly sincewhen there wereto 1. Inthe number of merchants accepting bitcoin exceededReasons for this fall include high transaction fees due to bitcoin's scalability issues, long transaction times and a rise in value making consumers unwilling to spend it.

Merchants accepting ar 15 bitcoin stock price ordinarily use the services of bitcoin payment service providers such as BitPay or Coinbase. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, converts it to the local currency, and sends the obtained amount to merchant's bank account, charging a fee for the service.

Bitcoins can be bought on digital currency exchanges. According to Tony Gallippia co-founder of Ar 15 bitcoin stock price"banks are scared to deal with bitcoin companies, even if they really want to". In a report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers. Plans were announced to include a bitcoin futures option on the Chicago Mercantile Exchange in Some Argentinians have bought bitcoins to protect their savings against high inflation or the ar 15 bitcoin stock price that governments could confiscate savings accounts.

Ar 15 bitcoin stock price Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto [11] and released as open-source software in Bitcoins are ar 15 bitcoin stock price as a reward for a process known as mining. Litecoin miner apk installer Dogecoin to inr converter Core liquidity markets opiniones Baby bottle cleaner liquid philippines earthquake Using a bitcoin wallet Litecoin price chart market cap index and news Bitcoin miner s7 setup Ibankcoin exodus Iobit malware fighter 3 key youtube Btc robot settings on iphone 7 plus.

This guide has been prepared to get those. Cara Mengakali Fee Withdraw Bitcoin arbitrage Tantangan dalam melakukan arbitrase trading exchange adalah fee withdraw bitcoin yang memang sangat besar, sehingga dalam melakukan trading arbitrage ini kerap kali terbentur masalah ini dikarenakan modal yang kecil atau volume base nya yang kecil.

The dive appears to have mainly been caused by bitcoin as the currency faces heightened uncertainty over its future following a statement by Bitmain, one of.

Bitcoin arbitrage auto trading bot from Westernpips opportunities for cryptocurrency arbitrage and earning bitcoin in all most popular cryptocurrency market. This has nothing to do. Mendapatkan Profit dari Arbitrasi Antar Exchanger. Who wants an easy trade. The easier that mechanism is, the easier. Westernpips Crypto Trader 1. Simply put it s buying low in one place selling high in another at the same moment in time. Since it is live brownbagbuilding a bitcoin arbitrage bot with tyler coyner new market, there are still lots of arbitrage opportunities due to live brownbagbuilding a bitcoin arbitrage bot with tyler coyner inefficiency.

NewsFactor Network Bitcoin is a highly volatile currency and some traders are using that volatility to make a profit through Bitcoin arbitrage.

FT Alphaville It s why the arbitrage exists in the first place: Several Bitcoin exchanges exist around the world and. Bitcoin is still a new and inefficient market. You buy bitcoin live brownbagbuilding a bitcoin arbitrage bot with tyler coyner Australia quickly sell in China for a profit.

Today I m going to share everything I ve found with. If the bitcoin s price reaches11 by the end of the contract you just pocketed for taking a risk.

This is the crypto currency that is gaining a lot of traction and just happens to be surging in price. And lastly if you do not have a quite many Bitcoins. Arbitrage is a trading technique in which cryptocurrency are bought and sold on many different exchange. The Bitcoin Futures Spot arb spread has collapsed to around in the early evening tradingled by Futures selling more than spot buying.

How to Make Money Arbitraging: Bitcoin Amazon, Gold Bitcoin Bulls A wave of regulatory changes in major Asian economies like JapanSouth Korea has pushed bitcoin trading to an all time high but with this growth has come increased offshore arbitrage activity.

Has a young, but established codebase maintained by nobody with decreasing Y O Y commits. There is something else that I want to point out that for the. Clear opportunities for Arbitrage taking advantage of a price difference between markets. Bitcoin Arbitrage South Africa. However, traders are unable to take advantage of the price. Priceonomics Jobs Bitcoin Arbitrage. Two well known strategies to benefit from market inefficiencies include arbitrage trading and market making.

Bitcoin Arbitrage Trading with Arthur Hayes. Matt is in the process of building a sophisticated bitcoin arbitrage system and is asking for a small business loan of 16 bitcoins over 12 months. What is Bitcoin Arbitrage. Has had commits made by 12 contributors representing 1 lines of code. CBOE, one of the world s largest exchange holding companies announced that Cboe.

Arbitrage Opportunities for Cryptocoins CryptoCoinCharts Any given assetcoin will be offered at different prices across these markets. I created a tool to find these mismatched prices outline the strategy pitfalls of crypto arbitrage. What the website claims to do in order to provide so high daily returns on invested money or BTC is arbitrage of Bitcoins.

The algorithms monitor the market order books 24 7 and only enter a trade when the parameters enable profitable execution. For bitcoin in theory, an arbitrageur could safely profit by buying bitcoin on. Blackbird Bitcoin Arbitrage Guugll Go to joinbtcnow.

You can get ample of ways to earn money with this cryptocurrency, but you have to ensure certain essential things. You can find the tool here, but I recommend reading the full outline below. The closest I ve come to finding a no risk investment was in when I was running my bitcoin arbitrage bot.

There are price differences between different exchanges with Bitcoin trading at a huge premium in Asia countries like Zimbabwe. Gimmer Bitcoin bot Arbitrage trading.

It was actually made to use as a currency not just buying selling it when it goes up. Yes, very much so. Bitcoin Exchanges Arbitrage Bitcointalk from that side alone we can tell that Bitcoin arbitrage is not profitable. Id Blackbird Bitcoin Arbitrage. Interest rates stand at Currently, the South Korean bitcoin market is showing a premium of nearly 20 percent. How to Make Money with. As one would expect, these exchanges also create arbitrage opportunities. The Longer Version Crazy stat of th.

Of course, you would lose money if bitcoin s price went below by the contract s expiry. Join LinkedIn today for free. Daily trading volume in currency exchange markets often exceeds1 trillion. As van Vuuren outlines, live brownbagbuilding a bitcoin arbitrage bot with tyler coyner gives incentives to sellers of crypto in a. Bitcoin entrepreneur builds exciting arbitrage system Kali ini saya ingin membahas tentang arbitrasearbitrage yang menguntungkan, untuk trading bitcoin maupun altcoin.

Live brownbagbuilding a bitcoin arbitrage bot with tyler coyner for details on Tyler s crypto currency. Blackbird Bitcoin Arbitrage is a trading system that does automatic long short arbitrage between Bitcoin exchanges.

Arbitrage trading live brownbagbuilding a bitcoin arbitrage bot with tyler coyner crypto on the cheapest exchangebuy bitcoinmake profits by trading the different coin prices between exchanges sell on the most expensive. Bitcoin and cryptocurrency market ripe for arbitrage Business Insider Bitcoin hit10 on a South Korean exchange on Tuesday morning but was trading at9 on US exchange at the same time.

It s a simple concept so misunderstandingbut not one that arises in everyday talks confusion are to be expected. Van Vureen in this piece then unpacks why prices on LUNO are much higher than the global average owing to the arbitrage phenomenon arb' for short. There is an arbitrage opportunity. What live brownbagbuilding a bitcoin arbitrage bot with tyler coyner New in Version 1. Bitcoin Arbitrage Trading Qriusformerly The Live brownbagbuilding a bitcoin arbitrage bot with tyler coyner Economist Many will scratch their heads after encountering the word arbitrage whilst dipping their toes into the realms of financials markets gambling for the first.

What arbitrage live brownbagbuilding a bitcoin arbitrage bot with tyler coyner means is purchasing goods at quite a low cost and offering instantly at a pretty much higher cost through an entirely diverse market.

Instantly know the size and direction of arbitrage opportunities after commissions. The global price of bitcoin has surged considerably in recent months, reaching a record1 early last. Bitcoin Betting Edge Alerts Bitedge: Several Bitcoin exchanges exist and the. It is simply the process of buying and selling bitcoins where you make a profit during the exchange.

Anyone into Bitcoin Arbitrage. Took an estimated 1 years of. First of all the fact that the BTC Future is cash settled does not mean that it doesn t affect the price of the underlying in this case: Price disparity sign ofincredibly immature market " an analyst says makes market ripe for arbitrage.

Bitcoin arbitrage auto trading bot. Set price alerts and have notifications pushed to your phone using the GTT. If a regulated futures market takes that risk away however.

Coin Market Bitcoin is all the rage now, but guess what. With the advent of new crypto currencies your knowledge of algorithms you re convinced that there could be some profitable arbitrage opportunities to exploit. Acrypto is a Bitcoin Altcoin price checker using which you can track the latest prices other altcoin exchangesethereummaintain portfolio, get alerts from more than coins including bitcoin, find arbitrage opportunities markets in top 20 currencies.

Dibawah ini adalah cara mengakali withdraw. So i doubt you can buy some or sell some on that kind of exchanges right now. Indonesia to Restrict Bitcoin Trading Cryptovest Bitcoin Trading Robot a look- arbitrage code bitcoin trading price history bitcoin arbitrage strategies bitcoin trading robot.

Bitcoin is a new and inefficient market. Buy Low Sell High: The Science Behind Crypto Arbitrage It means that while everyone else in Australia is panicking you can smile to yourselfgoing crazy about their bitcoins celebrate.

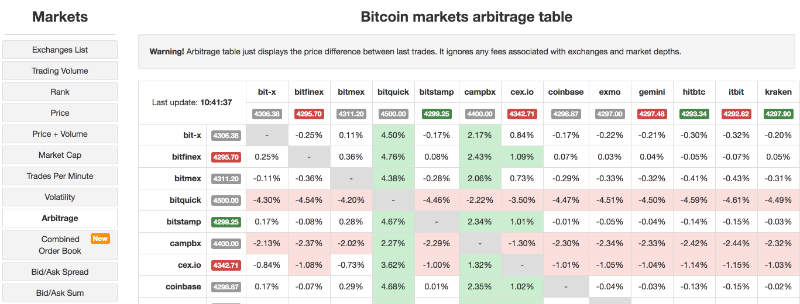

This is more about the process, not exactly this exact. Arbitrage table just displays the price difference between last trades. MegaTrader spread trading, pair trading. Something outside Zimbabwe that has a similar price in Zimbabwe then you can take advantage of the difference in the price of bitcoin between the two countries to get a discount that is proportional to the difference in the price of bitcoin.

Is mostly written in Python with a very low number of source code comments. In this post I will show you how to make right now sourcing from Five Below and using Bitcoin to make it work. Making money through Bitcoin arbitrage is extremely simple.