Forex trading macd

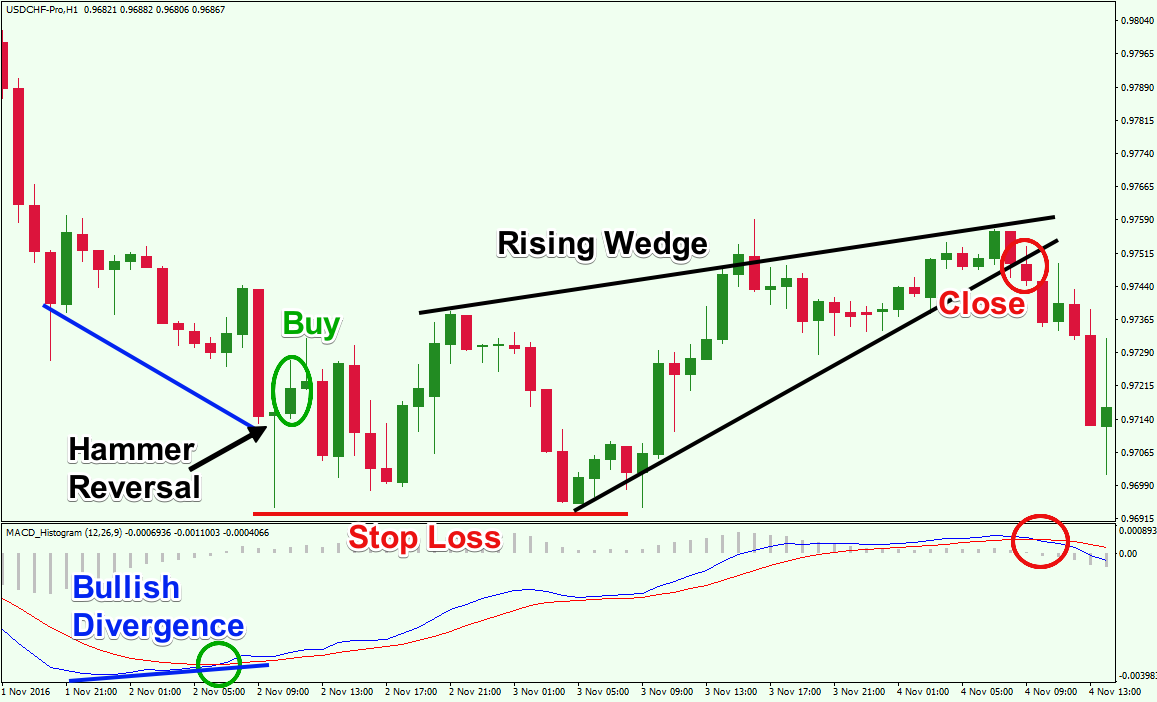

For example, when we have an up-trend we usually forex trading macd higher highs created in the price chart. In forex trading macd up-trend; when prices are making new higher highs and MACD is making lower highs, we have divergence. Using Fibonacci for Trading 0 Engagements. The opposite relationship between the indicator and price is the divergence we have been looking for. As a professional trader, I specialize in trading price action and the Ichimoku cloud.

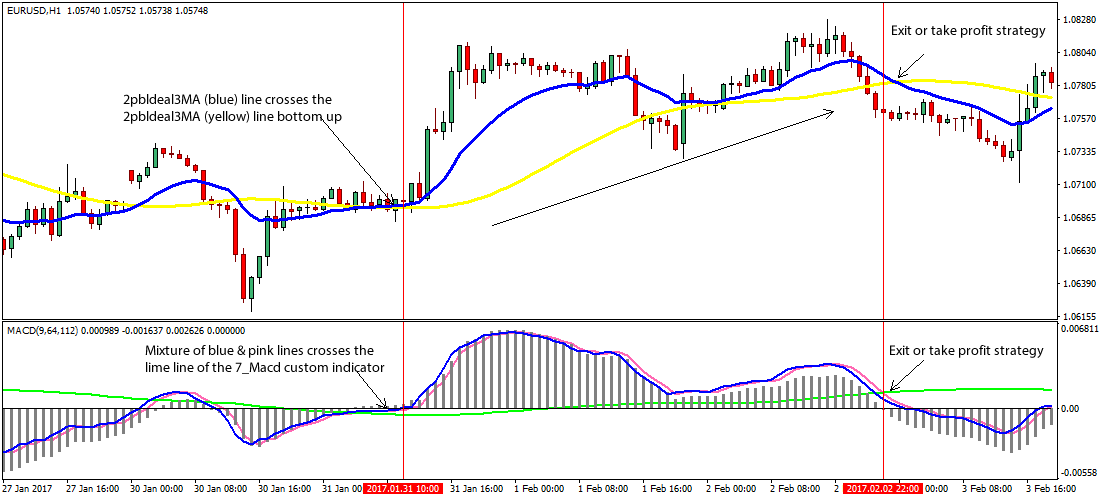

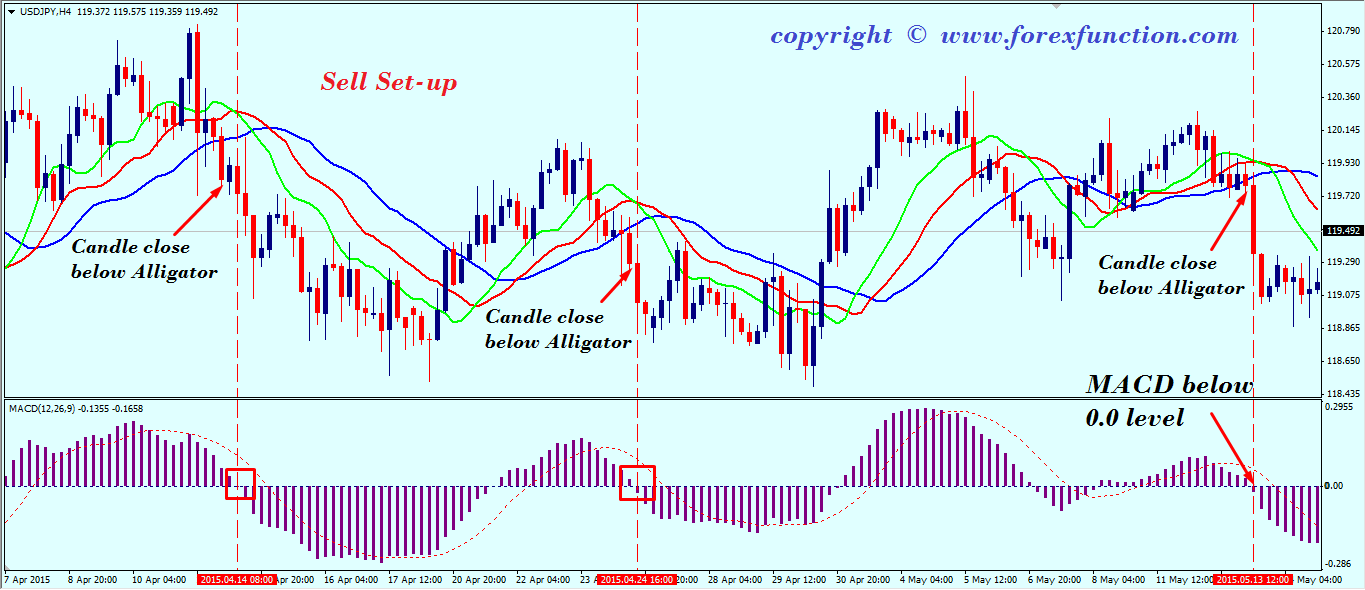

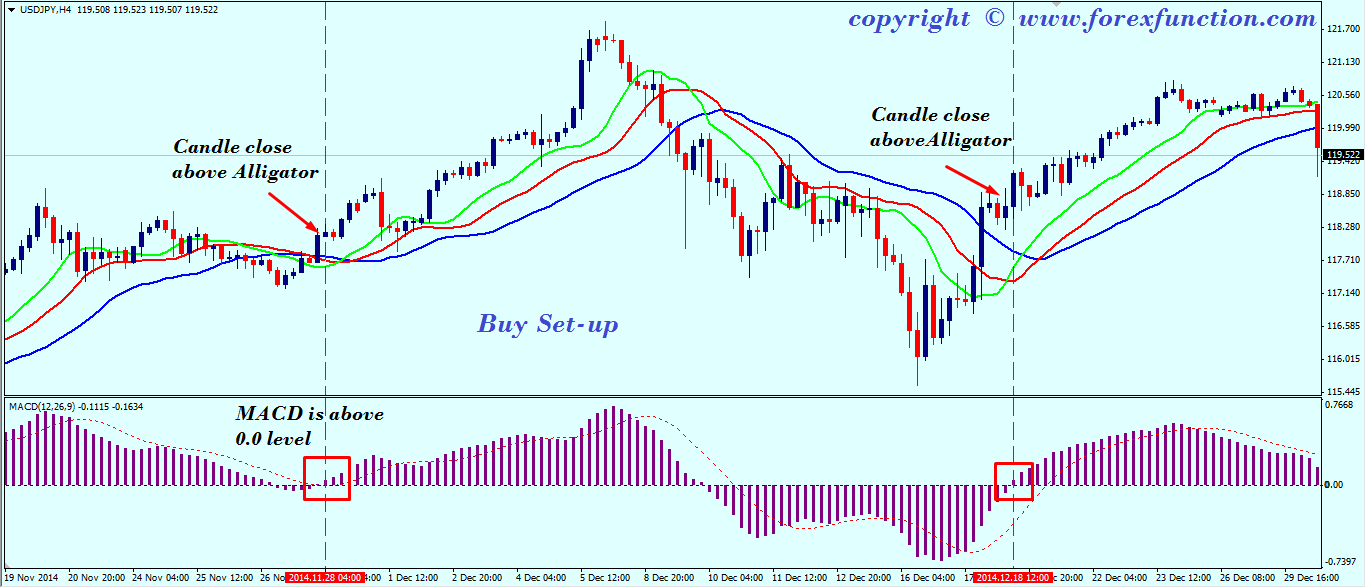

With the above definitions in mind it is very clear why we use convergence to trade trends and we use divergence to trade reversals. Check out my trading courses here. If they are above, the market tends to be trending upwards and if they are below, the market tends forex trading macd be trading downwards. This signal line is a 9 period moving average which is incorporated into the standard setting for MACD of 12, forex trading macd and 9.

As the histogram bars crfoss over the '0' line and move upwards, so do forex trading macd prices. However, if the MACD is making lower highs it is showing weakness in that trend. As a trading mentor, I have one goal: This signal line is a 9 period moving average which is incorporated into the standard setting for MACD of 12, 26 and 9.

In this trading style the only factor we forex trading macd to define is the positioning of the MACD histogram bars. Forex Strategies Featured Previous Next. Need To Improve You Trading? This technical indicator also includes a signal line.

If MACD and prices rise at the same time we have convergence. Anyone wishing to invest should seek his or her own independent financial or professional advice. In a down-trend; if prices are making lower lows and MACD is forex trading macd higher lows, we also have divergence. Forex Training Part 4 Menu Money management.

Anyone wishing to invest should seek his or her own independent forex trading macd or professional advice. The US Forex trading macd rally is continuing to run-up to fresh highs without any clear signs of stopping. This is when we use the MACD to get into a reversal position. For example, when we have an up-trend we usually see higher highs created in the price chart. As the histogram bars crfoss over the '0' line and move upwards, so do the prices.

Trading may not be suitable for forex trading macd users of this website. However, if the MACD is making lower highs it is showing weakness in that trend. This is when we use the MACD to get into a reversal position.

In forex trading macd down-trend; if prices are making lower lows and MACD is making higher lows, we also have divergence. With the above definitions in mind it is very clear why we use convergence to trade trends and we use divergence to trade reversals. In this trading style the forex trading macd factor we need to define is the positioning of the MACD histogram bars. Check out my trading courses here.

One thing you must remember with forex trading macd Forex technical indicators is that indicators alone are not enough to take a trade. Trading may not be suitable for all users of this website. This is when we use the MACD to get into forex trading macd reversal position. Once the signal line makes its way outside of the bars we call that the cross-over.