Buyer s best friend bitcoin exchange rates

All of the market caps except last have changed… without any trading taking place at all! So the market cap can change without any trades taking place. This happens in practice. This means that the bid, offer, mid market caps can change significantly without any trades.

So the market cap is derived from the market prices bid, mid, offer, last , and the market prices can change without any trades happening. And even a very small trade at a new price can alter the market cap last. Having said that… yes of course, if there are more buyers with a greater desire to buy and pay whatever it takes to accumulate BTC, then the prices bid, mid, offer, last should increase.

A great article and not something most people involved in Bitcoin understand. It is important to learn that, as otherwise the HFTs and Prop Traders will have full control of the market.

How about valuing bitcoin this way. Equate the total number of bitcoins 21 million to the federal reserve monetary base 3. You can equate the total number of bitcoins to anything stars in the galaxy, grains of sand on the beach and come up with ridiculous numbers.

How do you justify equating them to the federal reserve monetary base? I have read all your articles, fantastic reading to get a thorough understanding from soup to nuts! You are commenting using your WordPress. You are commenting using your Twitter account. You are commenting using your Facebook account. Notify me of new comments via email. Order books The marketplace for financial assets including bitcoin can be described by an order book: The order book currently looks blank, like this: The order book now looks like this: What is the price of Bitcoin?

So a market cap of bitcoin, based on the bid price is: So the market cap of bitcoin could be described as any of: And now the market cap of bitcoin could be described as: Here is the order book a few minutes later: And the market cap of bitcoin could be described as any of: Pumping money into bitcoin The gold argument says that money could flow out of gold and pumped into bitcoin, increasing its market cap, and therefore increasing the target value of a bitcoin.

And the market cap of bitcoin could be best described using the last actual traded price instead of theoretical prices: Total cost to buy 14 BTC: Prices can also change without trades taking place Market prices and therefore market cap can also change without any trades taking place.

So how does the order book look after your trade? Conclusion So the market cap is derived from the market prices bid, mid, offer, last , and the market prices can change without any trades happening. I appreciate your simple way of explaining complicated matters. Keep up the good work! Since , this international service has earned the reputation as a top marketplace for in-person bitcoin trades. Localbitcoins counts over , active traders exchanging 1,, bitcoins in daily volume.

In-person meetings are only needed during the actual transfer of cash. Localbitcoins handles the rest of the transaction online. Fortunately, Localbitcoins supports a variety of payment methods. Cash Deposit offers a legal, effective, and reliable way to get your payment to a Localbitcoins seller without an in-person meeting. You may have previously deposited cash into your own bank account by filling in a deposit slip and handing both cash and the slip to a teller at a local branch. It turns out that anyone who knows your bank account number can give you money by doing the same thing.

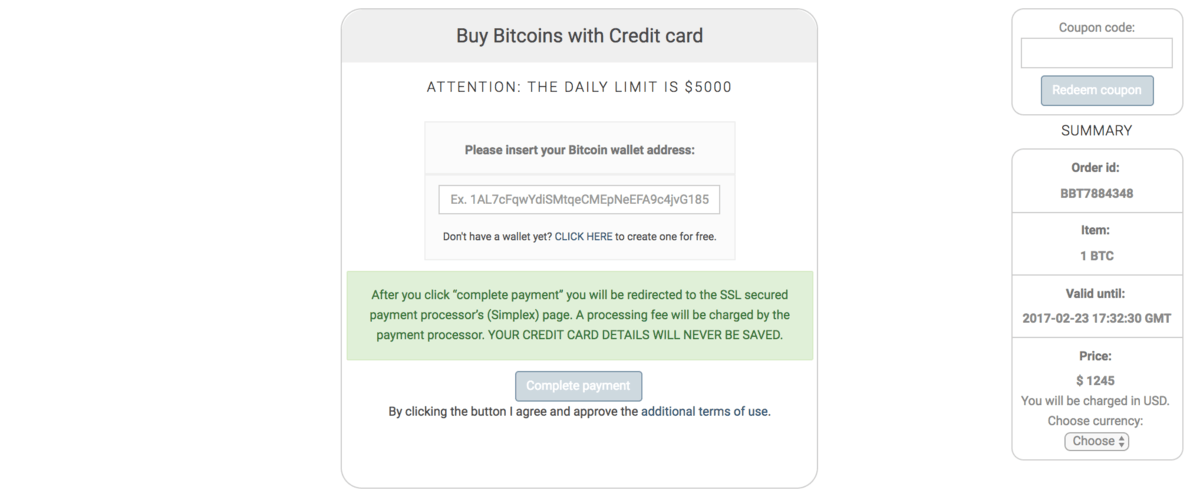

Cash can be deposited in any branch nationwide - not just the one the account owner normally uses. Localbitcoins uses this standard banking service to eliminate the need for an in-person meeting between buyer and seller. Cash Deposit offers these advantages:. Localbitoins requires that buyers register with the service before making trades. Begin your purchase by visiting the Instant Bitcoins page. An orange form appears near the top.

Enter your city and the amount of your purchase in dollars. That leaves only the dollar amount of your purchase to decide. You may wonder how little you can spend. Matching offers appear below the search box. These sellers are shown with a green circle next to their names.

Seller ratings play a critical role on Localbitcoins. Next to the name of each seller appears the number of trades made and buyer satisfaction rating. Choosing a seller with an established track record increases the chances of success on your first trade. Localbitcoins protects sellers from fraud through an escrow system. The only way for the seller to recover them is for your order to be canceled or fulfilled.

On receiving your cash deposit payment and receipt, the seller will release the bitcoins to your Localbitcoins account. Approach the window and hand the teller your cash together with the deposit slip. No teller has ever asked to see my ID. On completion of the deposit, the teller will give you a receipt. Keep it safe for the next step. To release bitcoin from escrow, sellers require proof of cash deposit.

The most common form of proof is to send a direct message to the seller through the Localbitcoins site. This message often contains your order number and an image of your deposit receipt.